The Power of a High Savings Rate

In the first post of this series (“Making A Game Out Of Budgeting”), we talked about focusing on Savings Rate. Today, I want to dive a little deeper into the Power of a High Savings Rate.

For many receiving a paycheck, at times it can be challenging to figure out exactly where you are in terms of saving versus spending. Here’s a basic equation we’re going to work with for this post:

Income (Paycheck) + New Debt = Spending + Savings

First things first. Taking on new debt is very detrimental for your short and long-term Financial Independence goals, so we’re going to take that out of the equation for now. If we take “new debt” off the table as an option, we are left with an easy-to-understand equation that, once you really internalize, allows for some radical options:

Income (Paycheck) = Spending + Savings

Everything you earn is either spent or saved. Which means, for every dollar that is saved, one less dollar will be spent. Obvious, right? But, the power comes from the understanding that this is not a one-to-one savings vs. spending ratio. The point of savings is to cover future expense needs, whether that is next month, next year or in retirement. Given that this is the case, every dollar that is saved instead of spent REDUCES the future need for spending. If you are spending less money, your savings lasts longer.

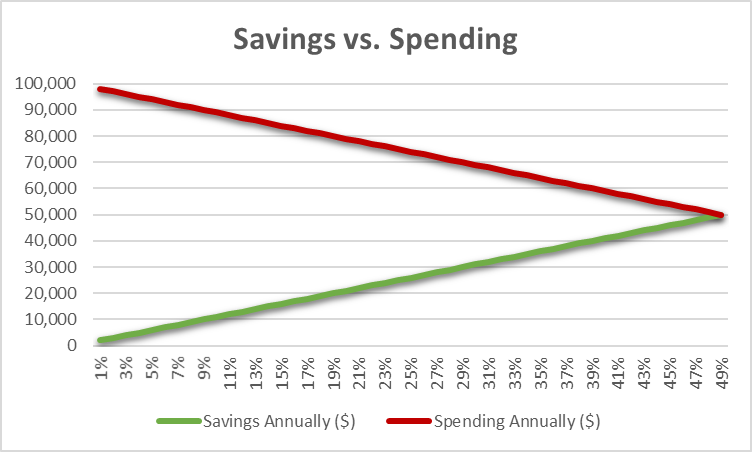

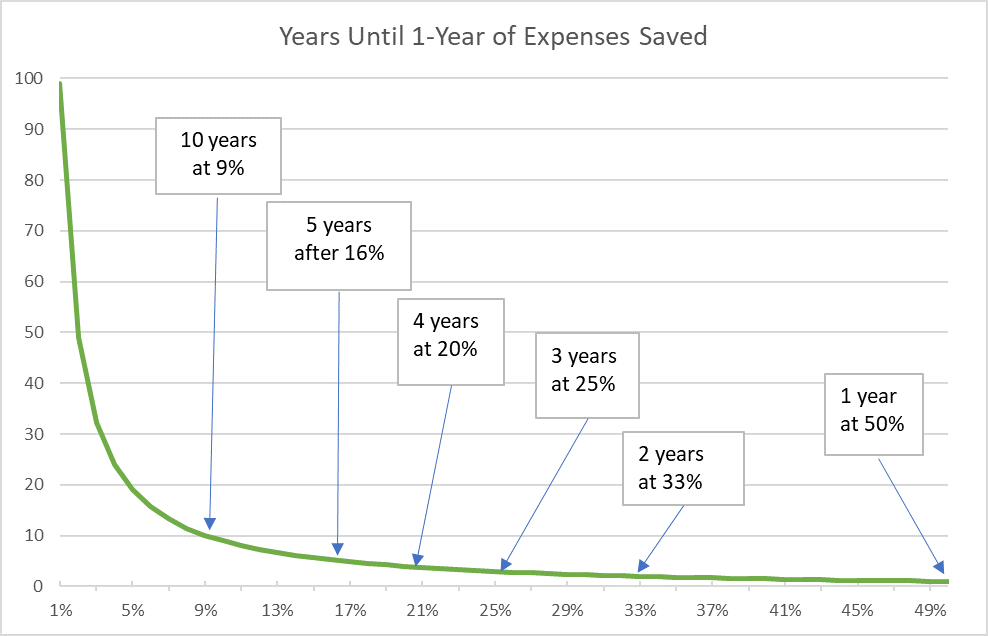

To clarify this further, take a look at these charts using a $100,000 annual income example:

This is the one-to-one ratio that we all think is happening between saving and spending. But, when we step back from just the 1-year annual view, the true power of a high savings rate comes into view:

Once you begin to save at higher and higher rates, you quickly cut the time needed to save to cover your expenses. You save more and save for a lower target.

And we haven’t even discussed investing and compound interest. The more you save, the more your investment earn and compound over time, which makes it even easier to become Financially Independent.

If you can get your savings rate above 20%-25%, you will quickly build wealth, giving you the freedom to pursue the life that you want, without the burden of worrying about money.

In our next post, we’ll tackle some ways to think about spending, so that you can find extra money to put towards savings.