2026 Tax Planning & Brackets

Tax planning is rarely about a single rate or rule. The most meaningful decisions come from understanding how tax brackets, capital gains, Social Security taxation, Medicare premiums, and surtaxes interact across different phases of life.

From a planning perspective, we use these thresholds together to guide planning moves, helping clients make informed choices that support long-term flexibility and tax efficiency.

Tax thresholds are subject to change based on future IRS guidance. This reference is intended for planning purposes.

Federal Income Tax Brackets & Standard Deductions

Federal income tax brackets are a core planning tool, not just a way to calculate taxes owed. In practice, we use them in a variety of ways, including evaluating pre-tax versus Roth contribution decisions during working years and identifying efficient income and Roth conversion strategies in retirement.

Planning fact:

Intentional tax planning often involves “filling” certain tax brackets while avoiding others as part of a broader effort to manage lifetime taxes, future required distributions, and Medicare-related costs.

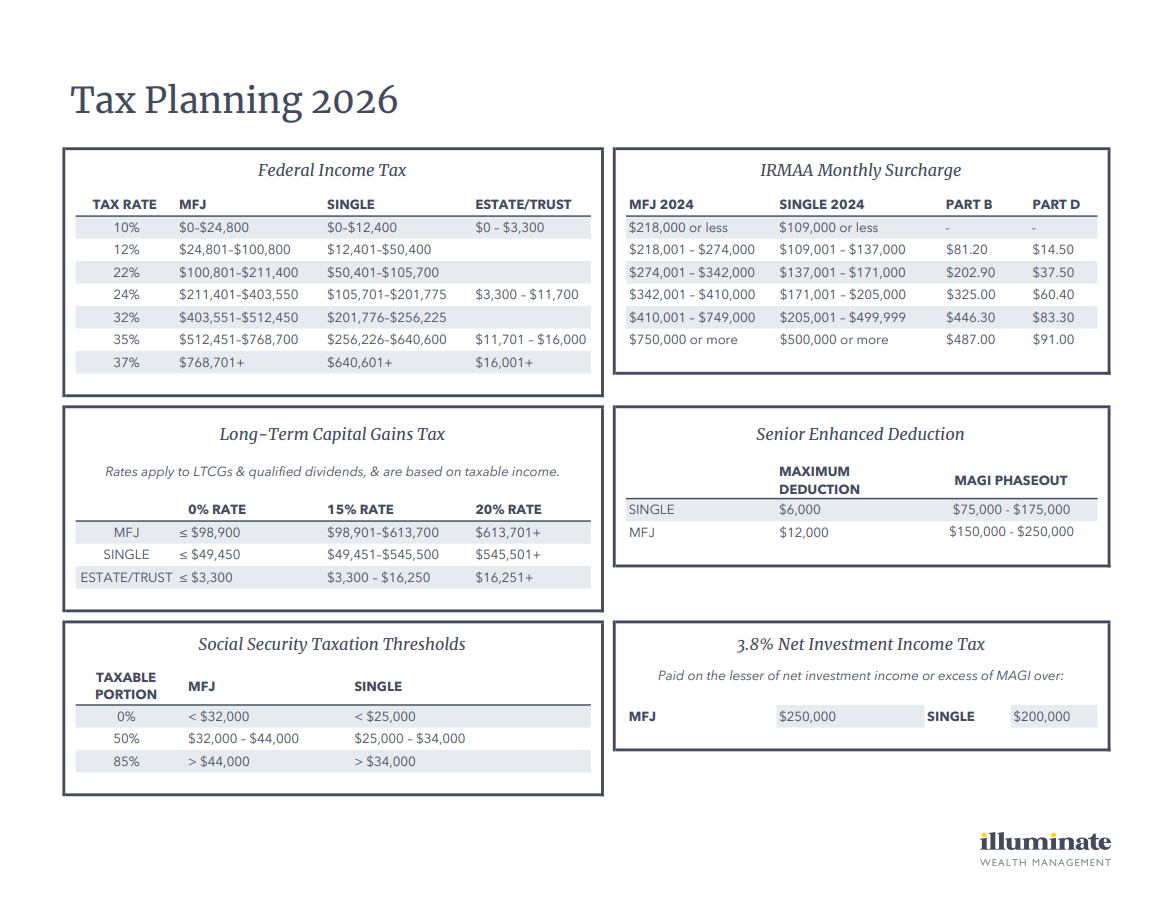

| Tax Rate | MFJ | Single | Estate/Trust |

|---|---|---|---|

| 10% | $0–$24,800 | $0–$12,400 | $0–$3,300 |

| 12% | $24,801–$100,800 | $12,401–$50,400 | — |

| 22% | $100,801–$211,400 | $50,401–$105,700 | — |

| 24% | $211,401–$403,550 | $105,701–$201,775 | $3,300–$11,700 |

| 32% | $403,551-$512,450 | $201,776-$256,225 | — |

| 35% | $512,451-$768,700 | $256,226-$640,600 | $11,701-$16,000 |

| 37% | $768,701+ | $640,601+ | $16,001+ |

Estimate as of 1/16/26 IRS has not released 2026 inflation-adusted brackets.

| Filing Status | Standard Deduction |

|---|---|

| Single | $16,100 |

| Married Filing Jointly | $32,200 |

| Head of Household | $24,150 |

| Married Filing Separately | $16,100 |

Long-Term Capital Gains Tax Rates

Long-term capital gains rates shape how investment decisions translate into after-tax outcomes. In planning, we look beyond the sale itself and focus on how realized gains interact with portfolio construction, rebalancing needs, and a client’s broader income picture.

Planning fact:

Capital gains are often most efficiently realized when they can be layered alongside other income sources without pushing total income into higher tax or Medicare thresholds, making timing and coordination just as important as the investment decision.

| 0% Rate | 15% Rate | 20% Rate | |

|---|---|---|---|

| MFJ | ≤ $98,900 | $98,901 – $613,700 | $613,701+ |

| Single | ≤ $49,450 | $49,451 – $545,500 | $545,501+ |

| Estate / Trust | ≤ $3,300 | $3,300 – $16,250 | $16,251+ |

Rates apply to long-term capital gains and qualified dividends and are based on taxable income. Estimate as of 1/16/26 IRS has not released 2026 inflation-adusted brackets.

3.8% Net Investment Income Tax (NIIT)

The Net Investment Income Tax adds an additional layer of tax on certain investment income once income exceeds specific thresholds. In planning, we view NIIT less as a standalone tax and more as a signal that total income has crossed into a different planning zone. The tax is calculated on the lesser of net investment income or the excess of MAGI over the threshold.

Planning fact:

Avoiding or minimizing NIIT often comes down to coordinating investment income, portfolio withdrawals, and one-time events so that investment returns are not unintentionally subjected to an additional surtax.

| MFJ | $250,000 |

|---|---|

| Single | $200,000 |

Paid on the lesser of net investment income or the excess of MAGI over the threshold.

Social Security Taxation Thresholds

Social Security taxation thresholds help determine how much of a client’s benefit may be included in taxable income. From a planning standpoint, we use these thresholds to understand how different income sources, such as withdrawals, earned income, or investment income, can affect the taxation of Social Security benefits.

Planning fact:

Because additional income can cause a larger portion of Social Security benefits to become taxable, coordinated income planning can help reduce the “stacking” effect that leads to higher-than-expected marginal tax rates.

| Taxable Portion | MFJ | Single/Head of Household |

|---|---|---|

| 0% | < $32,000 | < $25,000 |

| 50% | $32,000 – $44,000 | $25,000 – $34,000 |

| 85% | > $44,000 | > $34,000 |

IRMAA Monthly Surcharges

IRMAA (Income-Related Monthly Adjustment Amount) is an additional surcharge applied to Medicare Part B and Part D premiums for higher-income individuals. In planning, we use these thresholds to evaluate how income decisions today may influence future Medicare premiums.

Planning fact:

Higher income in a single year, such as from a Roth conversion or large capital gain, can trigger IRMAA surcharges for an entire year, making it important to weigh Medicare costs alongside income and tax planning decisions.

| MFJ 2024 | Single/Head of Household 2024 | Part B | Part D |

|---|---|---|---|

| $218,000 or less | $109,000 or less | — | — |

| $218,001 – $274,000 | $109,001 – $137,000 | $81.20 | $14.50 |

| $274,001 – $342,000 | $137,001 – $171,000 | $202.90 | $37.50 |

| $342,001 – $410,000 | $171,001 – $205,000 | $325.00 | $60.40 |

| $410,001 – $749,000 | $205,001 – $499,999 | $446.30 | $83.30 |

| $750,000 or more | $500,000 or more | $487.00 | $91.00 |

Senior Enhanced Deduction

Eligible taxpayers age 65 and older may qualify for an enhanced standard deduction, subject to income phaseouts. The income thresholds shown below reflect the senior means-testing provisions introduced under the 2025 One Big Beautiful Bill, which added MAGI-based limits to determine eligibility.

Planning fact:

This enhanced deduction can meaningfully reduce taxable income in early retirement years before required minimum distributions begin, but higher-income retirees may see the benefit reduced or eliminated due to senior means testing.

| Maximum Deduction | MAGI Phaseout | |

|---|---|---|

| Single | $6,000 | $75,000 – $175,000 |

| MFJ | $12,000 | $150,000 – $250,000 |

This guide reflects how we approach tax planning for clients nationwide as part of an integrated financial planning process. Schedule a meeting if you would like to find out more.